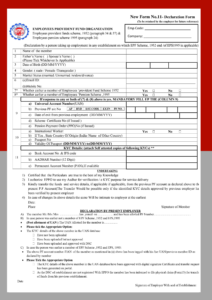

Procedure to fill Form 15G:

this form has two sections. The first part is meant for persons who want to claim no-deduction of TDS on fixed deposit interest. Fill up the following fields with proper details without errors. In the first part, there are 19 fields.

(1) Name of the Assessee (Declarant): Name of the taxpayer as mentioned on your PAN Card

(2) PAN number of the Assessee: Valid PAN card is mandatory to submit Form 15G. If you don’t have a valid PAN card then your declaration will be considered invalid.

(3) Status: Your income tax status which can be Hindu Undivided Family (HUF)/ Individual/AOP

(4) Previous Year (for which declaration is to be made): here applicant has to select the previous year as the financial year for which you are requesting the non-deduction of TDS.

(5) Residential Status: Indicate your residential status as a resident individual. Because NRI is not eligible to submit Form 15G.

(6-12) Address: so specify your communication address properly along with the PIN code.

(6) flat/door/block number

(7) Name of the premises

(8) road/street/line

(9) area/locality

(10) town/city/district

(11) State

(12) Pin code

(13-14) Email id and phone number along with STD code: give your valid email ID and working mobile number for further communications.

15 (a) whether assessed to tax under the Income-tax Act, 1961: make a tick mark ‘’Yes’’ if you were assessed to tax under the given provisions of Income Tax Act, 1961 for any of the previous assessment years.

(b) If yes, latest assessment year for which assessed: write the latest assessment year for which the returns were assessed.

(16) Estimated income for which this declaration is made: applicants have to specify the estimated income for which they are making a declaration

(17) Estimated total income of the previous year in which income mentioned in column 16 to be included: Total expected income for the financial year (which contains all the income)

(18) Details of Form No. 15G other than this form filed during the last year, if any: here declarants have to fill in the details about previous Form 15G anytime during the financial year. Then the mention the details of the previous declaration along with a total income need to be mentioned in the present declaration.

(19) Details of income for which the declaration is filed: this field has 4 subdivisions such as

- Identification number of the relevant income/account: applicants have to provide the investment account number (term deposit/ life insurance policy number/ employee code etc.

- Nature of income

- A section on which tax is deductible

- Amount of income

- Finally, make a signature on the space provided.

What is Form 15G? It is self-declaration for the fixed deposit holders.

- This can be used to prevent TDS deduction on interest earned.

- Eligibility to submit form 15G

- Applicant must be individual (and Resident Indian) or HUF or trust Applicant age must be less than 60 years old

- The income tax considered on your total income is nil

- Your total interest income earned for the year is less than the basic exemption limit of that particular year. At present Rs. 2.5 lakh for the financial year 2020-21.

However, Form 15G is very useful and helpful for fixed deposit holders. To save or decrease the TDS burden on the interest income. Therefore applicants have to provide the correct information in this form. Otherwise, officials find any false declaration to avoid TDS can lead to a fine or even imprisonment under Section 277 of the Income Tax Act, 1961.