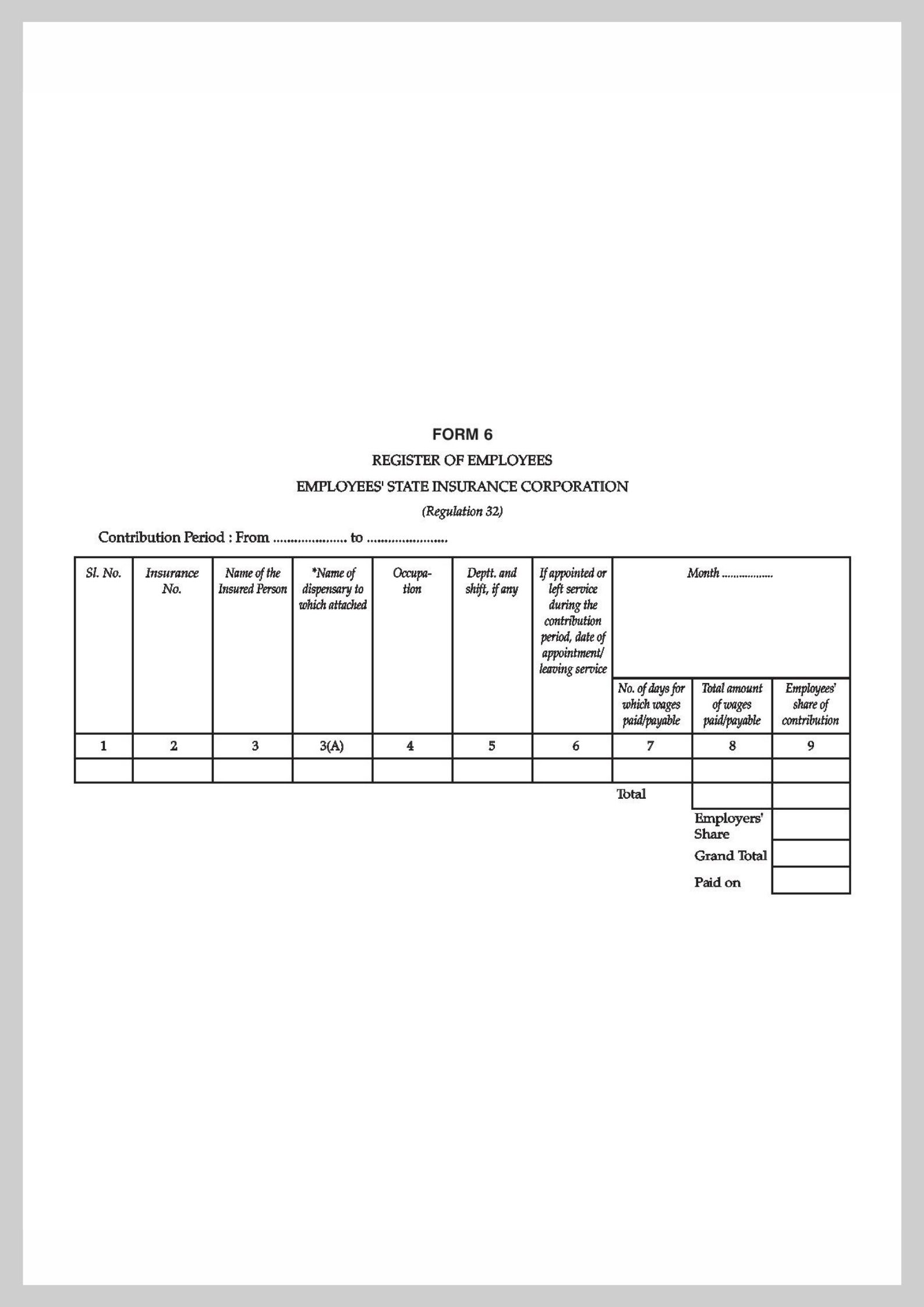

How to fill ESIC Form 6 columns: employees can easily download the form from the link below given. Actually, this form contains 29 columns. Follow the below step to fill this form.

1) Sl. Number: write the serial number.

2) Insurance Number: the Insurance number (ESI number) allotted to each employee as mentioned in the Employee Master

3) Name of the Insured Person: specify the name of the Employees who are eligible for ESI

4) Occupation: write the Designation of Employee as shown in the Employee Master

5) Rate of Wages etc., in the first wage period: write the wage per day in the first month, in the Block Period

6) Department and shift, if any: specify the details of the Department of Employee as shown in the Employee Master. Shift particulars if any essentials to be entered manually

7) If appointed or left service during the contribution period like date of appointment / leaving service: show the appointment date of the Employee, if the employee is still working with the company. If the employee has quit the job then the resignation date will be entered in this column.

8) Father’s or Husband’s Name: write the Father’s/Husband’s name of each Employee as stated in the Employee Master.

9) Insurance No. given by the corporation (to be entered at the branch office): mention the unique ESI number chosen to each employee from ESIC as stated in the Employee Master.

10) Number of days for which wages paid/payable: write the total number of working days for which wages is paid/payable for the given month for the employee

11) Total amount of wages paid/payable: specify the total wages/salary paid/payable for the employee.

12) Employees’ share of contribution: mention the Employee share of ESI contribution for the given month is already printed in this column for each employee

13) The last row in the 9th column displays the total amount of the wages paid to all the employees throughout the given month.

14) The 3rd last row of column 10 displays the total amount value of the Employer’s ESI contribution in the given month.

15) The 2nd last row of column 10 displays the total of ESI (sum of Employee’s and Employer’s contribution) forwarded to ESIC during the given month.

16) The last row of column 9 displays the ESI remittance date, written based on the Challan date.

17) Total Number of days for which wages paid/payable in Contribution Period: mention the total number of working days for which salary/wages is paid/payable during the selected contribution period for employee

18) Total amount of salary/wages paid/payable in Contribution Period (Rs): specify the total wages (salary) for the given six months is printed in this column for each employee.

19) Total Employee’s share of Contribution in Contribution period (Rs): write the total wages/salary paid to all the employees during the selected Contribution period.

20) Daily wages (27/26): shows the amount of ESI contribution for the particular Contribution period for each employee.

21) Remarks: Remarks if any essentials to be entered manually

22) The last row of column 27 displays the Total wages paid to all the employees in the given six months.

23) The last row of columns 28 and 29 displays the total of all the ESI contributions finished for the given six months.

What are the benefits of ESIC From registration?

ESIC is the Employee State Insurance Corporation. It is an autonomous body formed by the law and working under the Ministry of Labour and Employment, Government of India. Employees who registered under Employee State Insurance will get many provisions like

- Medical Aids to an employee and his family members

- illness assistances will be given 70% (in the form of salary), in case of any certified disease certified and which continues for a maximum of 91 days in any year

- Maternity Assistance to the women who are pregnant (paid leaves)

- In case the death/disability of the employee occurs while on work – 90% of the salary is given to his dependents every month after the death of the employee

- Funeral expenses are given to the family members

- Old age care medical expenditures will be given to the employees.

However, Employee State Insurance CorporationForm 6 is used to register the employees. Therefore the information given in this article is useful for those employees who want to register their details.