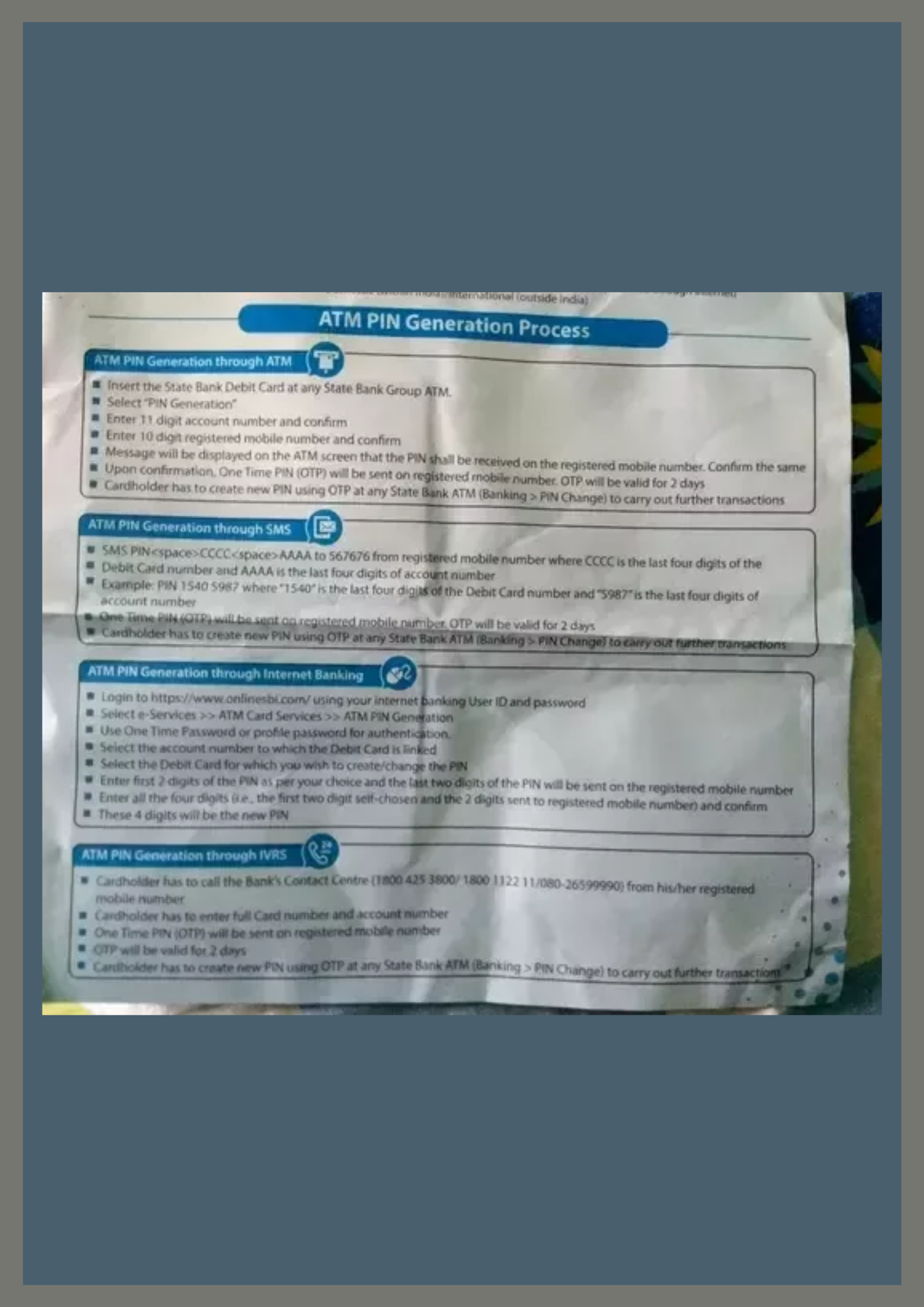

Basically, the Personal Identification Number keeps all SBI customers secure from any unauthenticated trades. All online transactions, withdrawals, and POS transactions are done only after entering the 4 digits PIN. Therefore one must know the SBI ATM PIN generated process before using the SBI ATM Card.

How to Generate SBI Card PIN through SMS

SBI Green PIN can be generated by sending a message from the account holder’s registered mobile number. So follow the below-given steps to generate the PIN number.

Step 1: From the customer registered mobile number, send an SMS to 567676 using the format PIN

Step 2: Here ABCD denotes the last 4 digits of the SBI ATM card and EFGH denotes the last 4 digits of the SBI Account Number.

Step 3: Once the SMS is sent to the registered mobile number, the SBI account holder will receive an OTP (One Time Password). Thus the account holder can use this OTP within 2 days for the SBI PIN generate process at any one of the nearest SBI ATMs.

How to Generate SBI PIN through Customer Care

Using the customer registered number,

call on 18004253800 / 1800112211 / 080-26599990. then select the desired language For SBI ATM PIN Generate Process, press ‘1’ Select ATM and Prepaid Card selection by pressing ‘2’

then enter the SBI ATM Card number and check the ATM card number by pressing ‘1’

Enter 11 digits SBI Account Number and confirm the account number by pressing ‘1’

Then SBI account holder will obtain an OTP on the registered mobile number, it is valid for 2 days

Within the definite 2 days’ time, visit any nearest SBI ATM, Insert the SBI card in the ATM and Select ‘Banking’

Select language English, Hindi, or any regional language

On the next window, enter the OTP received on your registered mobile number

From the ‘Select Transaction’ menu select the ‘PIN Change’ option

Enter a new 4 digit PIN of your choice and re-confirm the same

If the procedure is successful you will see a message, ‘Your PIN has been changed successfully’

Then the new PIN then becomes the real PIN for your SBI ATM card and it can be used for all card transactions.

About PIN number: While issuing credit cards or debit cards, most of the private sector and public sector banks, provide a PIN that permits card usage at ATMs and point-of-sale (POS) terminals. Banks started issuing debit cards or credit card PINs to the customers through PIN mailers.

Therefore it is the most popular delivery method. The envelopes hide the PIN number with scratch-off sheets which also help to disclose any kind of tampering attempts.

PIN envelopes are usually sent to the cardholders’ address through courier or postal service. Later on, some banks started handing over the PIN envelope directly to the customers along with a welcome kit. Therefore if any customer wants to change the PIN for any reason. Then they need to visit the nearest bank branch to submit an ATM PIN regeneration request form.

If postal delivery may get late if the PIN envelope gets damaged or tampered with during transportation. Then banks need to send a new PIN, which increases the postal and stationery charges to the banks. So for the inconvenience for customers, the PIN regeneration bank made a revolutionary step towards green banking.

That is paperless banking, so SBI bank customers can generate their PIN at any time according to their comfort.

However PIN is mandatory for each and every account holder, so keep this number secure. We hope the information in this article regarding SBI PIN generation is useful for new users.